NEW BUSINESS MODELS

Only a few people have really understood the impact which blockchains (and distributed ledger technologies in general) will have. The field of innovation for digital assets has developed into a serious economic segment in recent years. Hundreds of millions of dollars are invested in cryptocurrencies such as bitcoin, ether, and cardano.

The first generation of blockchains, especially Bitcoin, has been used as a store of value. The second generation, like Ethereum, was already able to carry out complicated transactions with smart contracts. Because of technical limitations, Ethereum can now hardly scale anymore. And with a number of new blockchains, completely new business models will open up in the future. It is very clear to me: The coming decades will be a great success story for the new blockchains and other DLT projects.

This is precisely why I am trying to learn about their respective meaningfulness, follow technical developments, and train myself with blockchain programming. For a good reason: If experiences, ideas and trends come together, better problem solutions can be created.

The subject of cryptocurrency is not new to me: I ran own miners and a Bitcoin full node as early as 2015. The evolution of blockchains is currently opening up new opportunities in which I would like to be actively involved.

SOLVING PROBLEMS

There are currently more than 100,000 coins and tokens in the blockchain market. There is an almost confusing number of currencies out there. But only very few solutions are innovative and sustainable. For some, the only thing that counts is quick money: pull up the cryptocurrency, cash in, and leave it along. But the big innovations usually happen quietly in the background. An example of this is the development of the Cardano blockchain, which aims to remove existing inadequacies in Ethereum and other blockchains. Since autumn 2021, developers can use Cardano’s in-house programming language to bring new DApps (“Distributed Apps”), oracles (interfaces), and smart contracts (complex transactions) into the Cardano blockchain.

The tools for this new world are just being created. But what these technical innovations lack are programs that solve real problems. And this is exactly where I want to bring solutions for the finance, insurance and/or real estate industries into play.

HOW I CAN HELP

CONCEPT

Creation of suggestions for problem solving with the use of blockchain protocols.

FLOWS AND PROCESSES

Design and implement IT-driven business processes that fulfill certain goals.

SALES

Market and sell solutions in the blockchain space.

ROADMAPS

Ensure that the technology is matching the planned development steps of the product.

PRESENTATIONS

Communicate the envisioned or realized steps in order to achieve a successful product.

COORDINATION

Work together with colleagues, decision makers, business partners and external companies.

CREATING INFORMATION ARCHITECTURE

An important factor for the success of a blockchains project is its meaningfulness and the ability to actually solve problems. The fact that a blockchain is responsible for dealing with these problems in the background of an app/Dapp should be completely irrelevant for most users. So the goal is to help users solve a specific problem or complete a task. Thanks to the new blockchains, new business models are particularly useful in these sectors: finance, insurance, and real estate.

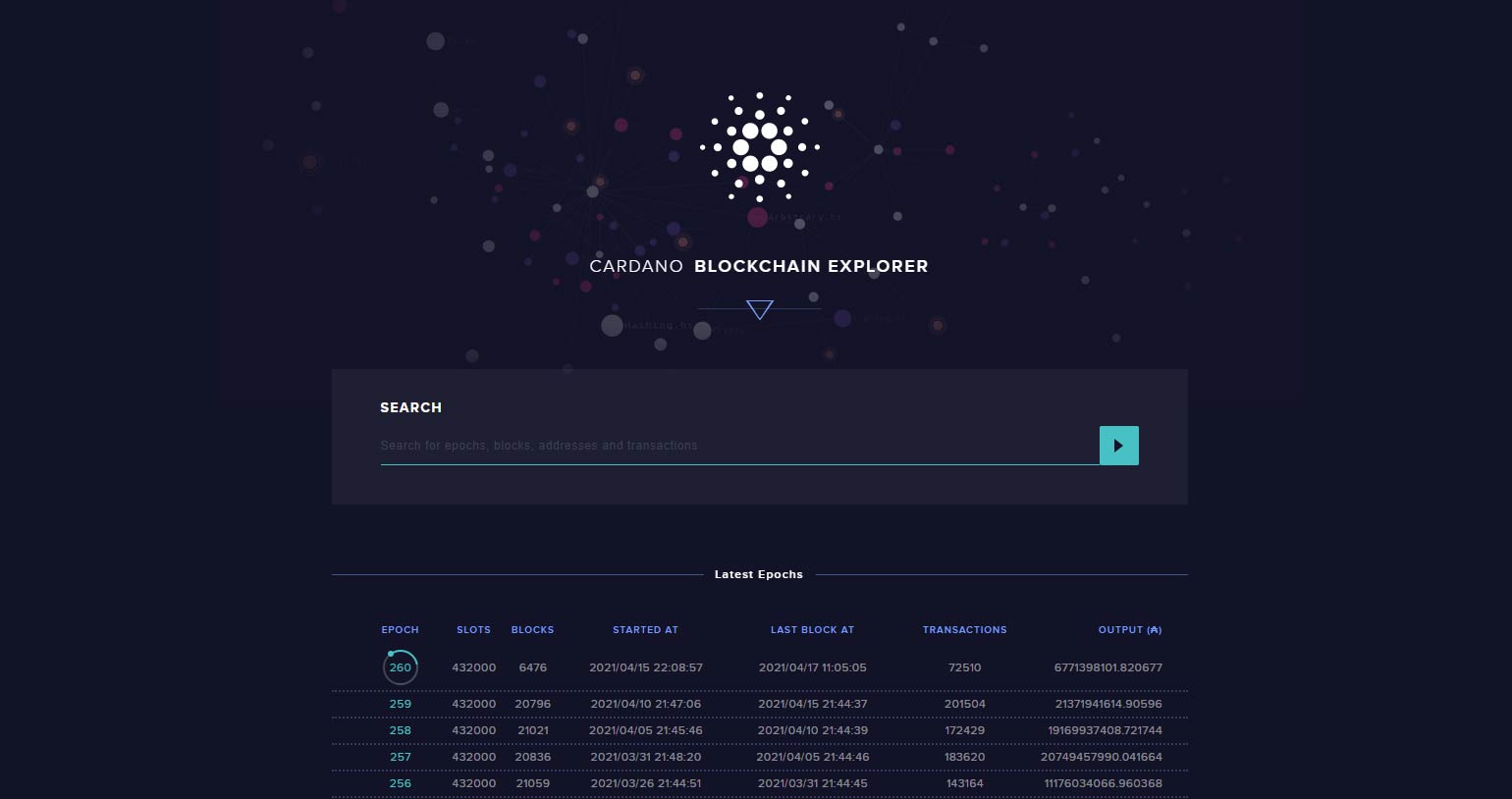

The Cardano Blockchain Explorer allows you to look at the Cardano blockchain. Here is an example of a generated block that contains a certain number of transactions. It is easy to recognize that, for example, no IP addresses are stored. In a similar way, you can take a look at any other blockchain with the corresponding Explorer.

REGULATION IS EXPECTED

Blockchain projects are also not always transparent from a technical viewpoint. There are protocols like Ripple that have a private area for InterBank transactions. The Monero blockchain even goes one step further: it stores transactions in such a way that tracking payment details is difficult if not impossible. On the one hand, this is an advantage for obfuscation, but is likely to have a negative impact on expected regulations by lawmakers.

Meme tokens and shit tokens in particular are likely to fall victim to regulations after millions of private investors have burned their hands as a result of losing their investments. In addition, I particularly expect the regulation of centralized and decentralized crypto exchanges, for example to prevent wash trading. Another field of regulation could be the transparency rules on how crypto project obtain funding before or during an Initial Coin Offering, Initial Exchange Offering, Initial DEX Offering, Crowdloan, or other means of financing.

Under my observation, stablecoins are especially facing regulatory pressure. Although these coins are on “paper” at parity with the US dollar, they are often not actually covered by the full amount of money in circulation. Additionally, their holders are not protected against total loss. The crash of some of these stablecoins could even trigger a new financial crisis, because now there are significant amounts of values in stablecoins. In addition, some or all of the stablecoins are restricted or banned in certain jurisdictions: after all, crypto projects are usually traded using them.

Blockchain Certifications

In January 2022 I took up a new professional challenge as Head of DeFi/Node Operations at BLOCKSIZE. This was one of the reasons for taking crypto certifications. The first training of this kind was passing the Certified Bitcoin Professional (CBP) exam. Then I took the Certified DeFi Expert exam provided by the Blockchain Council, which was about a general understanding of the market Decentralized Finance.

Digital Token Identifier Foundation

In May 2024, I joined the Digital Token Identifier Foundation (DTIF) as an expert member of the Product Advisory Committee (PAC). By joining it, I will now collaborate with other industry experts on the future of digital asset standards. A right step in driving adoption of DTIs in Germany and other countries.

Finance Loop

In the spring of 2022, I launched a Frankfurt blockchain meetup together with three other enthusiasts. Especially with the waning of the corona pandemic, I wanted to set an example and thus boost networking again. And with great success: Since 2022, four of these blockchain events took place with hundreds of participants. Due to the success of the expert panels, the event series eventually became the blockchain ecosystem Finance Loop.

Chainlink Node Operator

As Head of Node Operations at BLOCKSIZE, I have also been responsible for operating the blockchain infrastructure in several data centers since spring 2022. Together with my team, we ensure that smart contracts (and thus DEXs in particular) receive reliable market data. BLOCKSIZE is one of the highest quality Chainlink node operators and has a large number of blockchain nodes running for blockchain protocols such as Ethereum and Avalanche.

From May 2022 until January 2024 I have been officially accredited as a Chainlink Advocate in Frankfurt and Germany. In this function, I supported the development of communities around the topics of blockchain, Web3, Smart Contracts and of course market data. Chainlink Advocates are advocates for Chainlink’s blockchain technology. They build networks within the blockchain community, inform like-minded people, and thus create added value for everyone involved.

In April 2024, I organized a Chainlink event in Frankfurt as a pre-event of the Crypto Assets Conference.

Compliant Crypto Market Data

Professional market participants such as asset managers, trading venues, and banks need reliable market data to trade and hold cryptocurrencies. Unfortunately, even in 2022, there are still serious deficiencies in compliant market data about digital assets traded on blockchains. Many users use providers like CoinMarketCap or Coingecko as their prices without thinking about the challenges involved in determining prices.

That’s why I created a new product at BLOCKSIZE in summer 2022 that provides institutional users with one of the first compliant, transparent price data: BLOCKSIZE CONNECT. The product provides real-time trading and historical data on hundreds of liquid and illiquid assets for commercial purposes. For example, customers can use it to find out how the pricing took place, which trading prices were qualified as outliers due to deviations by outlier detection, and ensure that prices were not subsequently changed.

This crypto trading data offering is used today by customers, such as T-Systems, and well-known customers from the banking sector.

Monetizing Financial Data on Blockchains

Blockchains with support for smart contracts have an incredible range of possible use cases, which is only limited by the inventiveness of the developers. While smart contracts can communicate with API endpoints, any “off-chain” API endpoint is a single point of failure, unlike the blockchain itself. Therefore, from a blockchain decentralization perspective, an API endpoint cannot be trusted: the interface could be offline, hacked, or unintentionally sending false data. Oracle networks solve this problem.